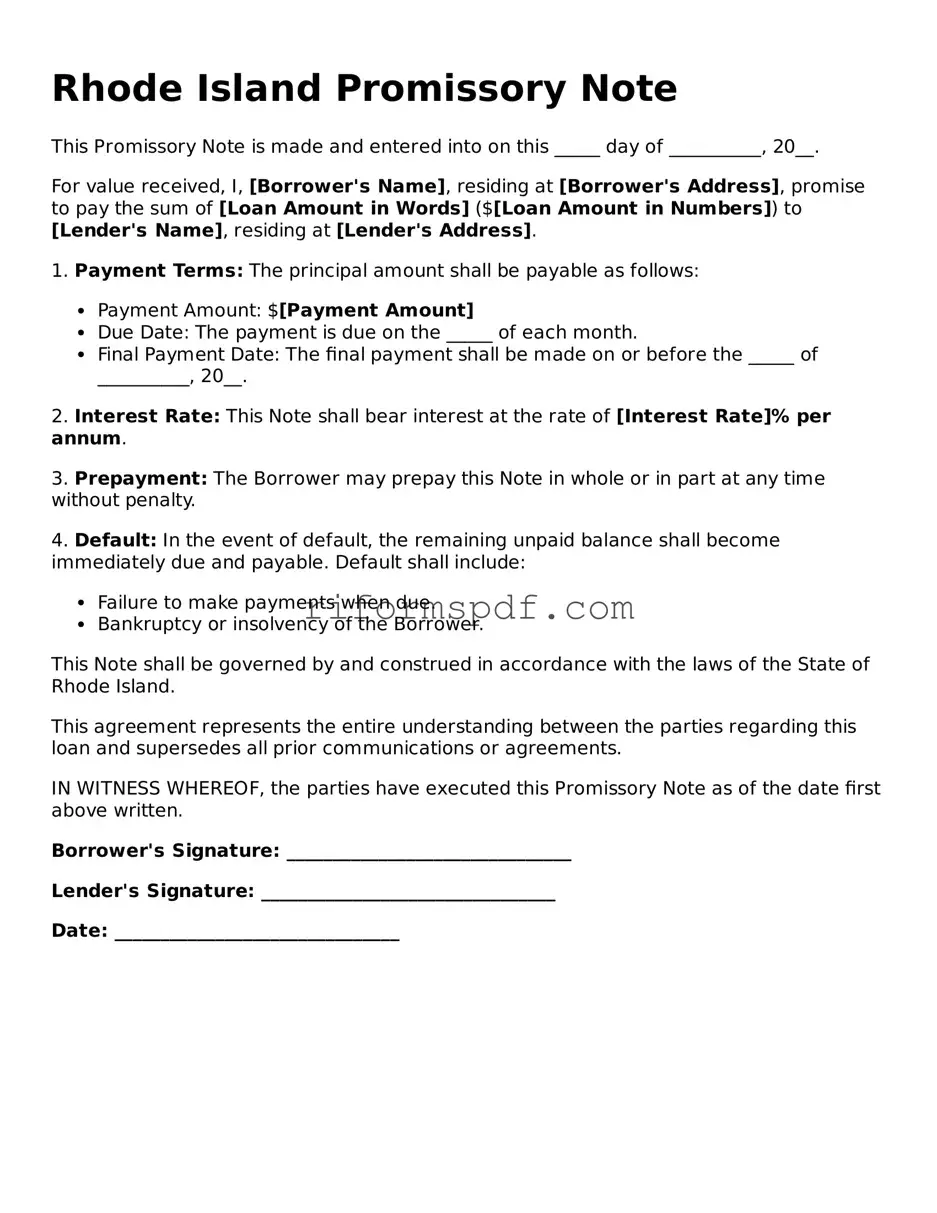

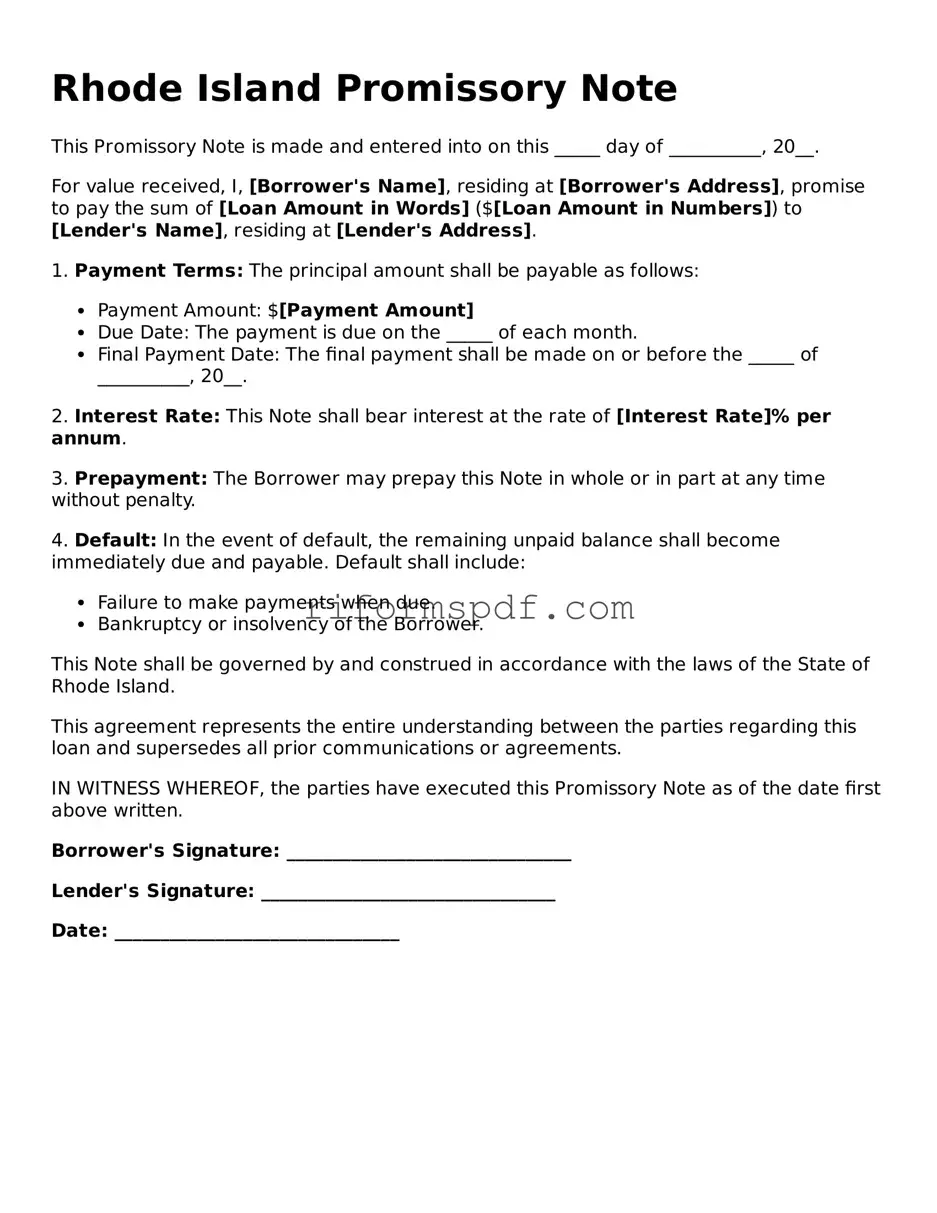

Printable Promissory Note Form for Rhode Island

A Rhode Island Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender under specified terms. This form serves as a written record of the agreement, detailing the amount borrowed, interest rates, and repayment schedule. Understanding this document is essential for both parties involved to ensure clarity and enforceability of the loan agreement.

Launch Editor

Printable Promissory Note Form for Rhode Island

Launch Editor

Finish the form now and be done

Edit Promissory Note online and skip the paperwork.

Launch Editor

or

⇓ PDF Form