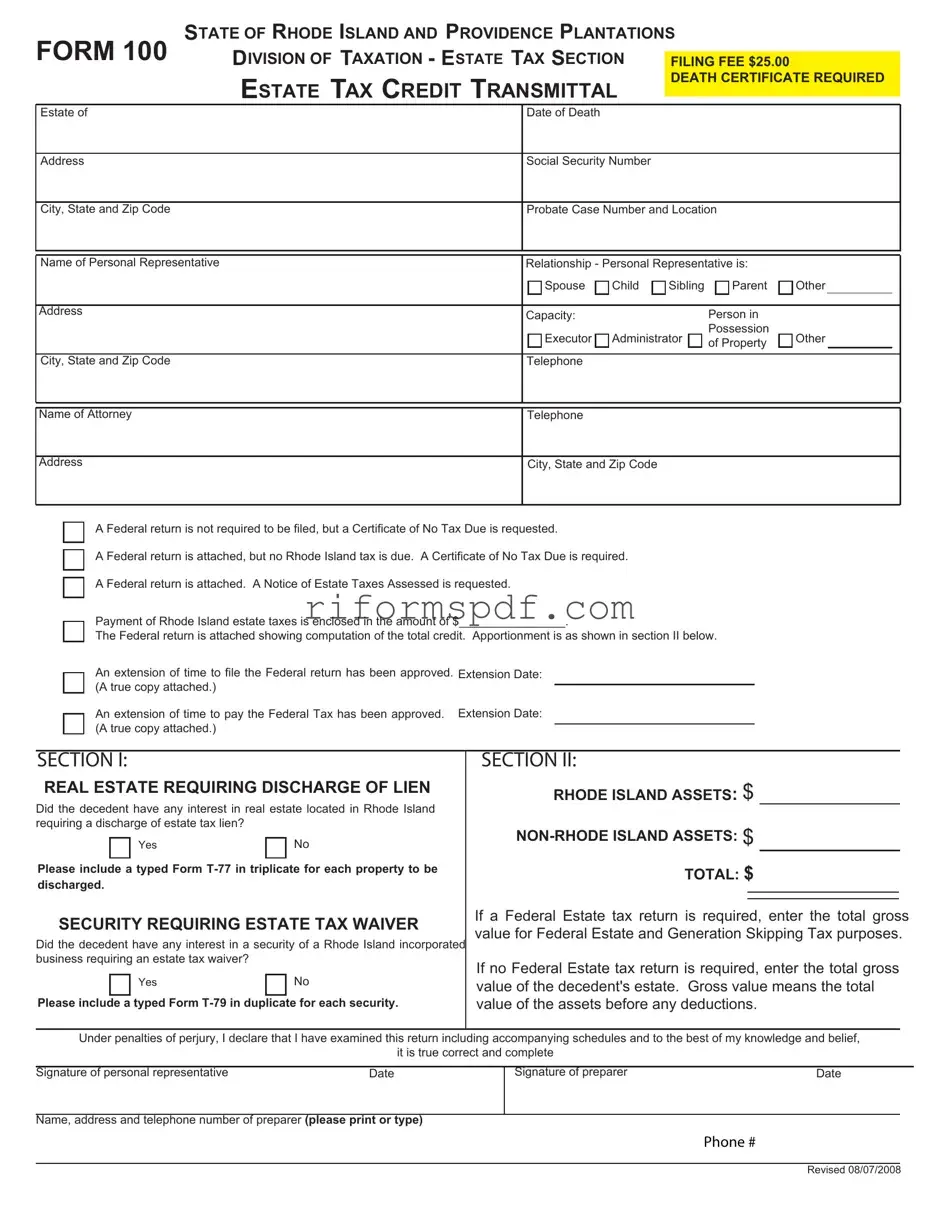

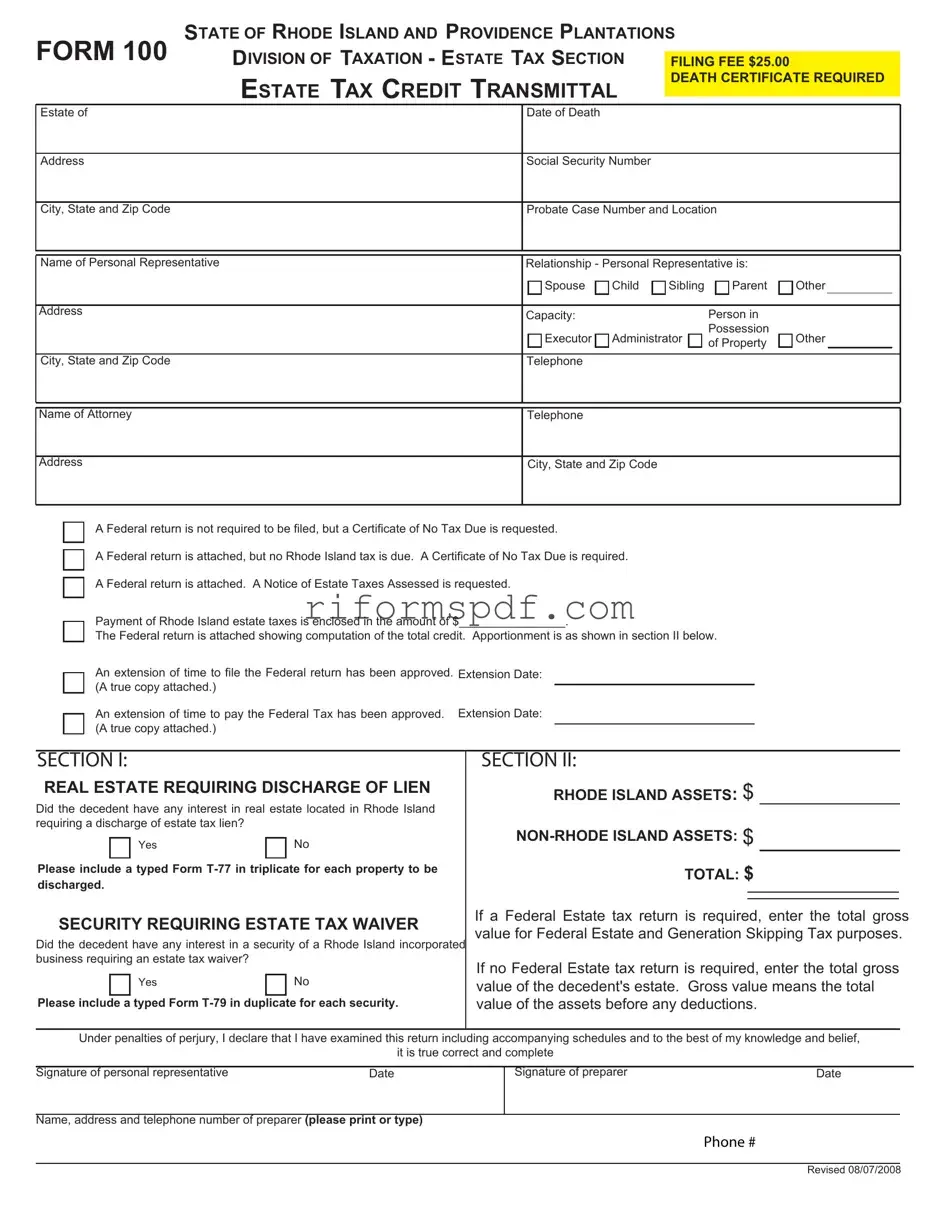

Blank Rhode Island 100 PDF Template

The Rhode Island 100 form is a crucial document used for reporting estate taxes in the state of Rhode Island. This form must be filed by the personal representative of a decedent's estate and includes essential information such as the date of death, the decedent's assets, and the relationship of the personal representative to the deceased. Understanding the requirements and implications of the Rhode Island 100 form is vital for ensuring compliance with state tax laws.

Launch Editor

Blank Rhode Island 100 PDF Template

Launch Editor

Finish the form now and be done

Edit Rhode Island 100 online and skip the paperwork.

Launch Editor

or

⇓ PDF Form