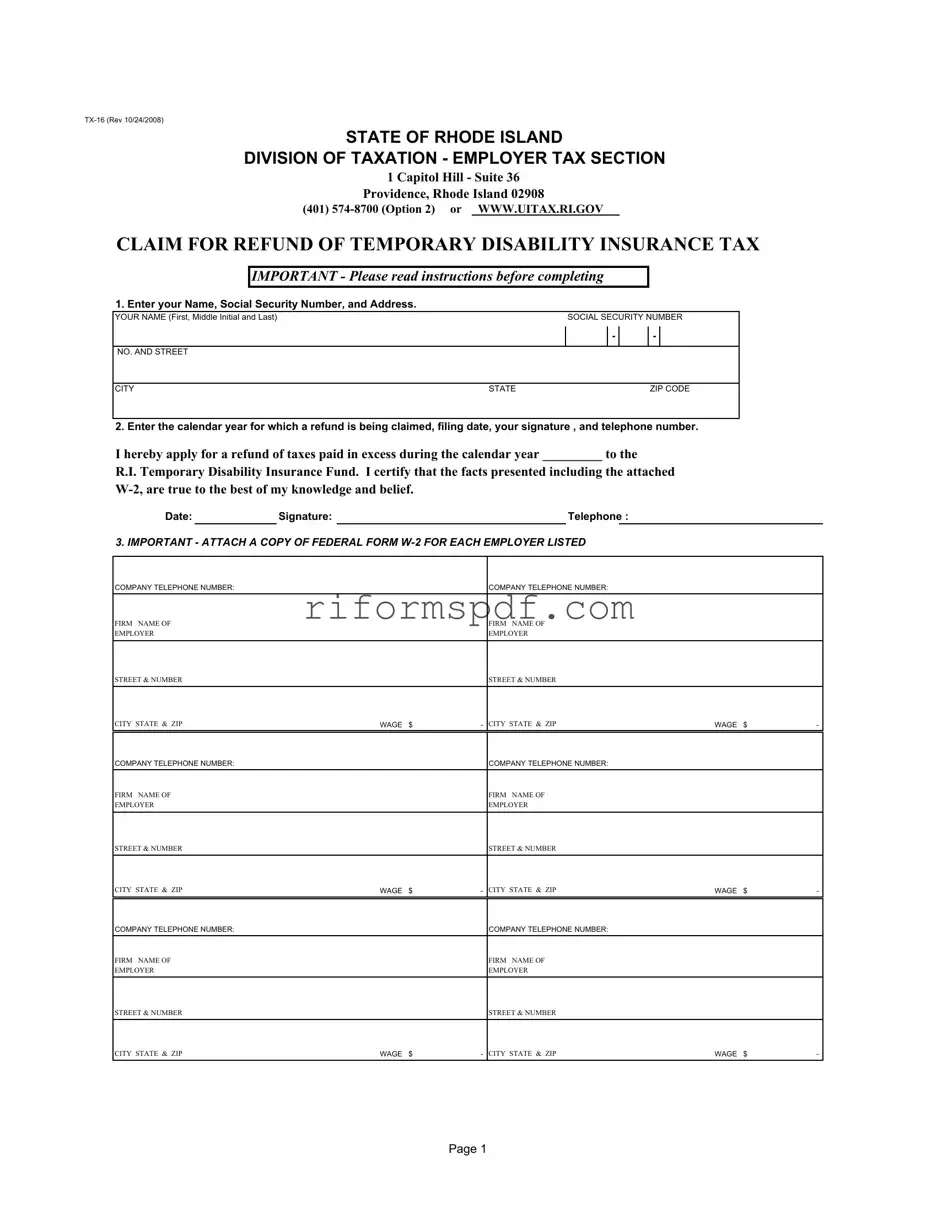

Blank Rhode Island Tx 16 PDF Template

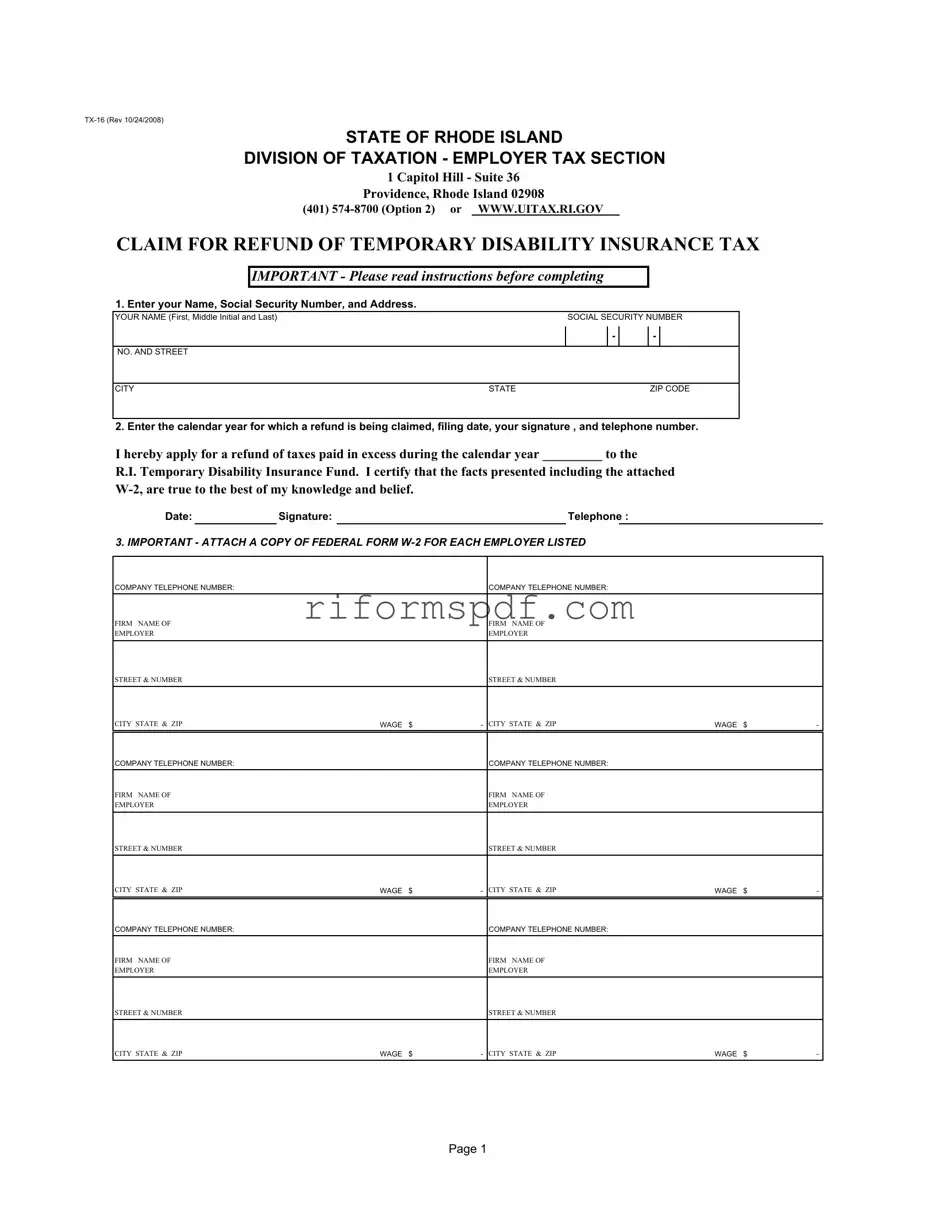

The Rhode Island TX-16 form is a document used to request a refund of Temporary Disability Insurance taxes paid in excess during specific calendar years. This form is particularly relevant for individuals who have worked for multiple Rhode Island registered employers within those years. It is important to follow the instructions carefully to ensure a successful claim for refund.

Launch Editor

Blank Rhode Island Tx 16 PDF Template

Launch Editor

Finish the form now and be done

Edit Rhode Island Tx 16 online and skip the paperwork.

Launch Editor

or

⇓ PDF Form