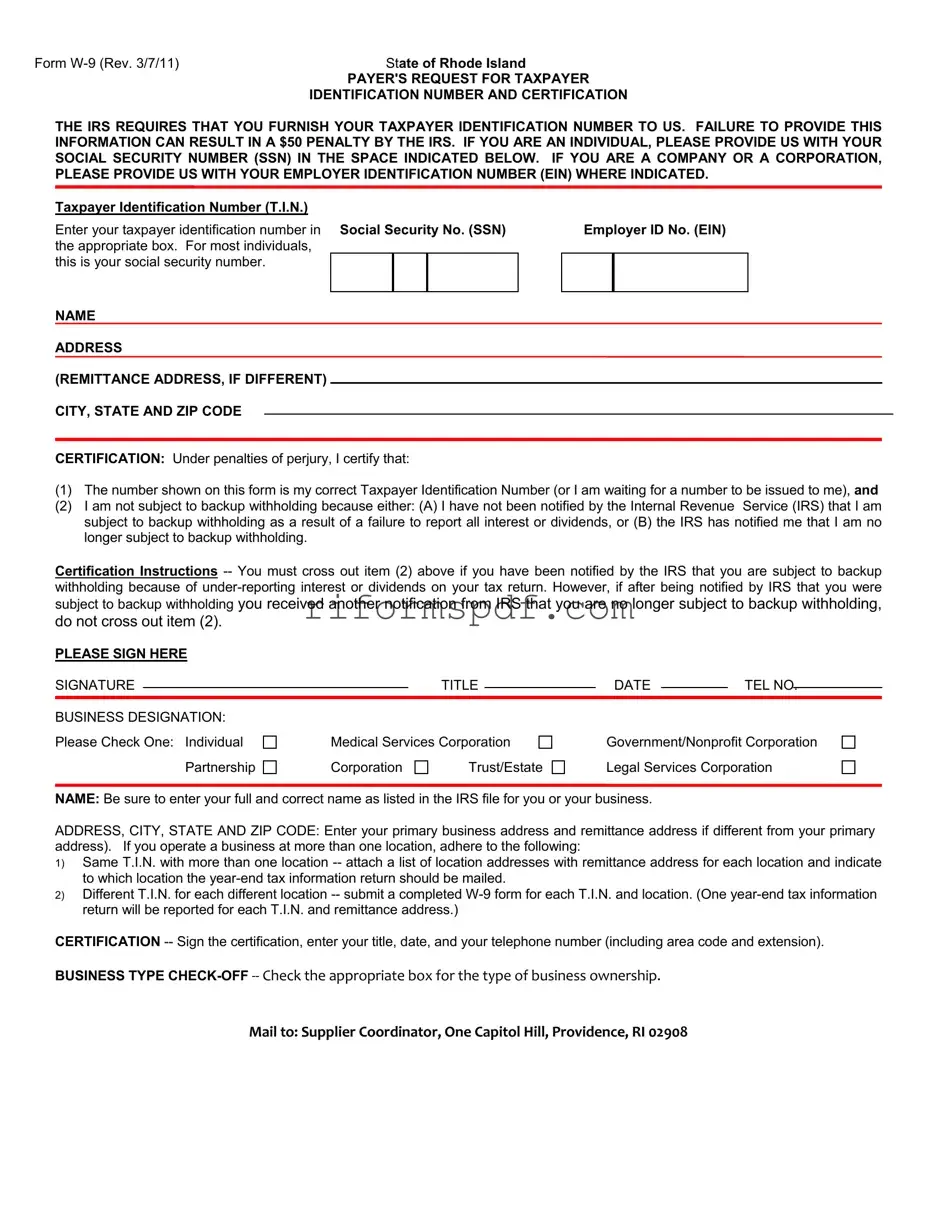

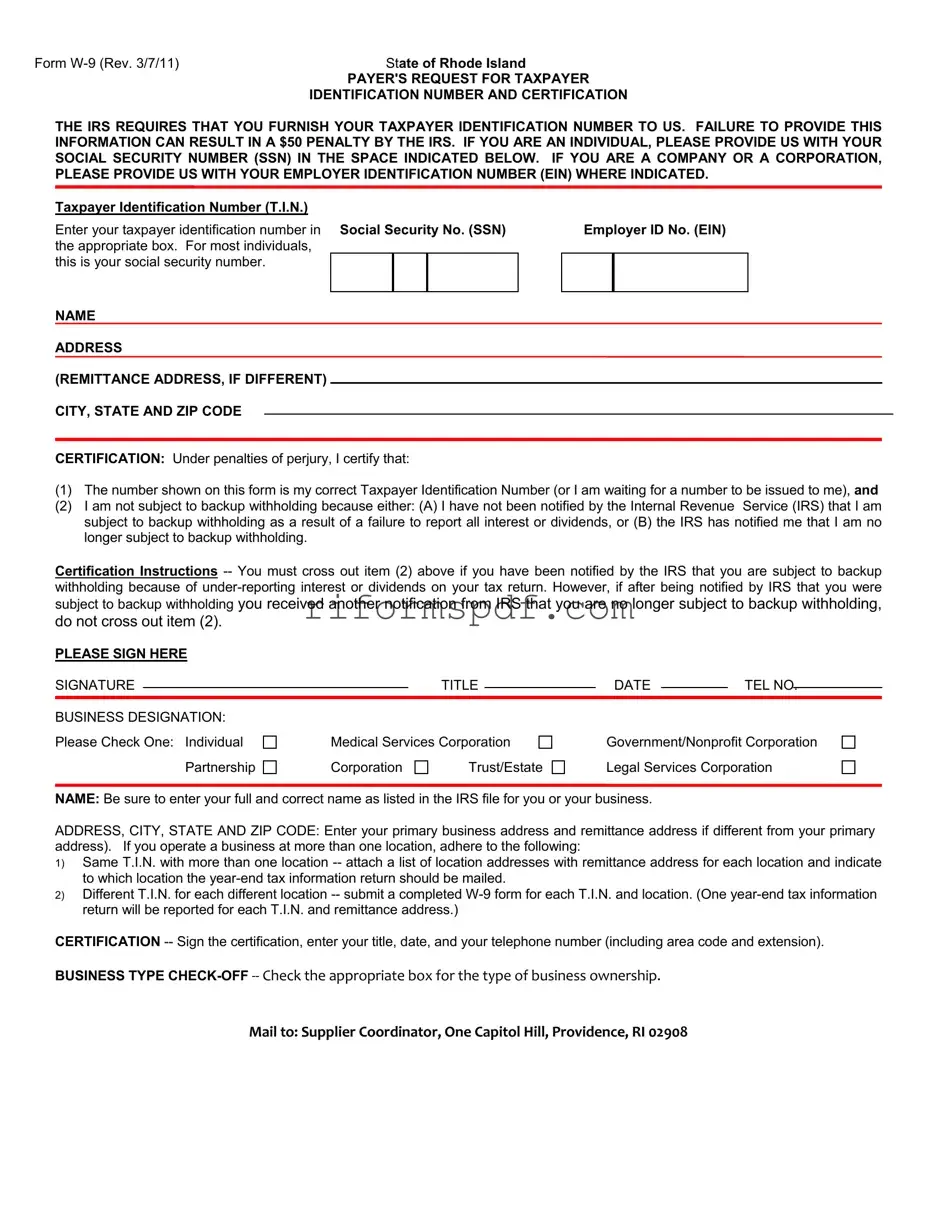

Blank Rhode Island W 9 PDF Template

The Rhode Island W-9 form is a document used to request a taxpayer's identification number and certification. This form is essential for individuals and businesses to provide their Taxpayer Identification Number (TIN) to the payer, ensuring compliance with IRS regulations. Failing to submit the required information may result in penalties, making it crucial for accurate and timely completion.

Launch Editor

Blank Rhode Island W 9 PDF Template

Launch Editor

Finish the form now and be done

Edit Rhode Island W 9 online and skip the paperwork.

Launch Editor

or

⇓ PDF Form